Monitor your brand in the retail channels with our Retail Tracker in Africa

Syndicated retail audits and brand performance across key African markets

SagaTracker is our Retail Tracker in Africa that provides data from on-the-ground measurements in a relevant panel of stores.

Categories

Non-alcoholic beverages

Bottled water, Soft drinks, Energy Drinks, Juices

Alcoholic beverages

Beer, Ready-To-Drink, Whisky, Vodka, Gin, Other spirits

Dairy

UHT milk, Fresh milk, Powder milk, Evaporated milk, Flavored milk, Yogurt, Sour milk, Cheese, Butter

Cooking ingredients

Edible oils, Bouillon, Tomato pastes, Mayonnaise

Biscuits and confectionery

Biscuits, Chocolate spreads, Chocolate confectionery, Sugar confectionery, Gum, Salty snacks

Baby food

Dried baby food, Milk Formula

Personal and health care

Bar soap, Hair Care, Skin care, Oral care, Diapers, Condoms

Home care

Toilet paper, Laundry care

Tobacco

Countries

| West and Central Africa Cameroon DR Congo Senegal Ghana Guinea Côte d’Ivoire Nigeria |

|

Frequency

Quarterly, Bi-annual

Pick your category and country, and start getting data with our Retail Tracker in Africa

What can you use SagaTracker for?

Assess the true performance of your brands and SKUs at the point of sale.

Set fact-based targets for your commercial plans and monitor progress.

Track your trade performance as well as the key market indicators on a regular basis.

Pick your category

Pick your countries of interest

Select your frequency

Track 7 key trade indicators with our Retail Tracker tool in Africa

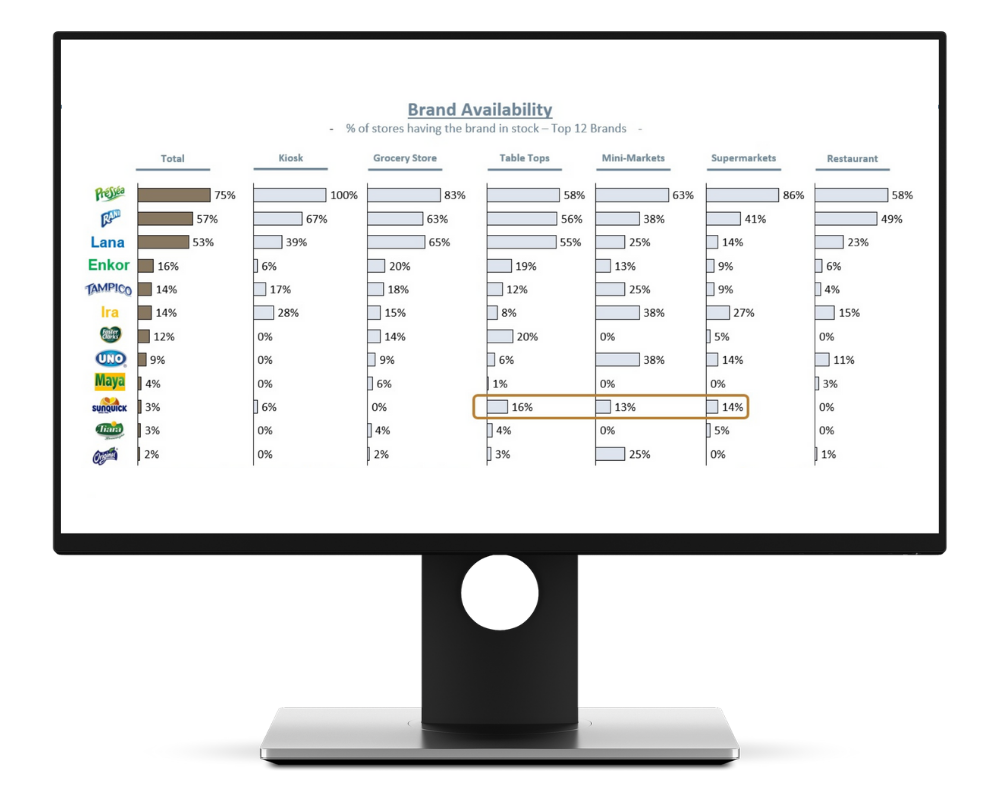

Indicators are available in total for the country or broken down by channel. Indicators available within our Retail Tracker tool in Africa

- Category availability within the panel

- Numeric distribution (of brands, SKUs and manufacturers)

- Share of stock and total stock available in the stores (of brands, SKUs and manufacturers)

- Price points of each SKU

- Market share in value (of brands and manufacturers)

- Market share in volume (of brands and manufacturers)

- Average category sales volume per store

Key channels covered

Grocery stores and mini-marts

Table tops

Supermarkets

HoReCa

Liquor stores

Pharmacies

Beauty stores

Continuously collect data and insights related to your brand in Africa

Track brand performance in stores

Monitor the trade performance for your key brands on an ongoing basis

Representative retail audit

Assess how your brand is doing across traditional but also modern trade channels

Granular understanding of brand performance

Monitor your performance at brand level but also down to the SKU and at channel level

Standardized approach

Allowing an easy comparison of KPIs between countries

Access the key performance indicators for your business

Numeric distribution, pricing, market shares,…

Pan-African coverage

Monitor your trade performance consistently across multiple markets

Immediate online access to collected data

No need to wait for a report, immediate access to the data, pre-analyzed and pre-charted. Our platform transforms raw data into structured analyses for your business

Online dashboard with all historical data

Downloadable reports

Downloadable datasets in XLS or CSV format

Get started

We are here to help you! Ask us anything or schedule a meeting!

Our insights from SagaTracker

-

Retail audits in Kenya: why FMCG brands need continuous retail tracking

Examples of retail audits in Kenya reveal how FMCG brands actually win or lose at shelf level, where distribution gaps, pricing execution and channel strategy often determine performance more than demand alone. In markets where traditional trade remains dominant, sales data alone rarely reflects true performance. Without reliable retail tracking, brands risk navigating complex retail

17/02/2026 -

Retail audit in DRC reveals strong regional patterns in the laundry category

Results from the latest retail audit in DRC / Democratic Republic of Congo, conducted by the Sagaci Research Trade team, shed light on strong regional patterns in supply chain dynamics and sourcing strategies in the country. Indeed, the vast geography of the country, coupled with deep regional differences hindering cross-regional trade, has led to distinctive

28/02/2024 -

Immersion in the food service industry in Africa: chat with a restaurateur in Mozambique

Post-COVID-19, the food service industry in Africa, as well as globally, faced significant challenges. Lockdowns, restrictions on dining in, reduced tourism, and economic uncertainties had a substantial impact on the restaurant industry. Many restaurants and eateries faced closures, reduced operating hours, and shifts towards takeout and delivery services to adapt to the new normal. With

30/10/2023 -

Shrinkflation in Africa: the smaller, the better (profits)

Shrinkflation in Africa (as elsewhere) consists of reducing the volume (in grams, liters or units) of a product while keeping the same price, sometimes along with a packaging change, so that it is barely noticeable. It tends to be more common during periods of inflation such as the one we have been facing in the

06/10/2023