- 08/08/2025

- Posted by: Monique Sperandio

- Categories: Articles, Confectionery, SagaProduct

The confectionery market in Africa is thriving, with local and international brands competing for consumer attention across diverse product categories: from chocolate and chewing gum to candies and sweets.

But which markets in Africa have the most developed confectionery sector? Within each market, which sub-categories are preferred by consumers? Which brands stand out? And who are the consumers of particular brands?

With SagaProduct, Sagaci Research’s shopper panel in Africa, we can answer all these questions and more. Read on to explore key highlights on the confectionary market across African countries.

Which market has the widest range of confectionery brands in Africa?

Members of our online panel across Africa continuously scan the barcodes of the FMCG products they purchase. This powers the SagaProduct database, offering a high-level view of category dynamics, including confectionery.

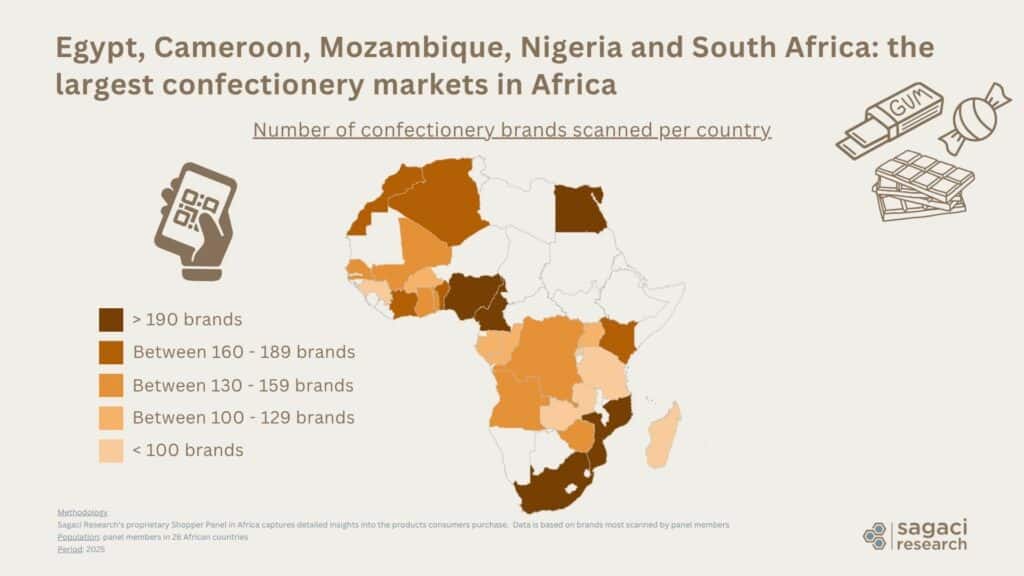

According to SagaProduct insights, the African markets with the highest number of scanned confectionery brands include Egypt, Cameroon, Mozambique, Nigeria, and South Africa. These countries stand out for their wide brand variety, underlining their strategic importance for FMCG manufacturers and distributors looking to grow in Africa’s confectionery segment.

Which confectionery categories are most popular across Africa?

Not all sweet treats are equal across Africa.

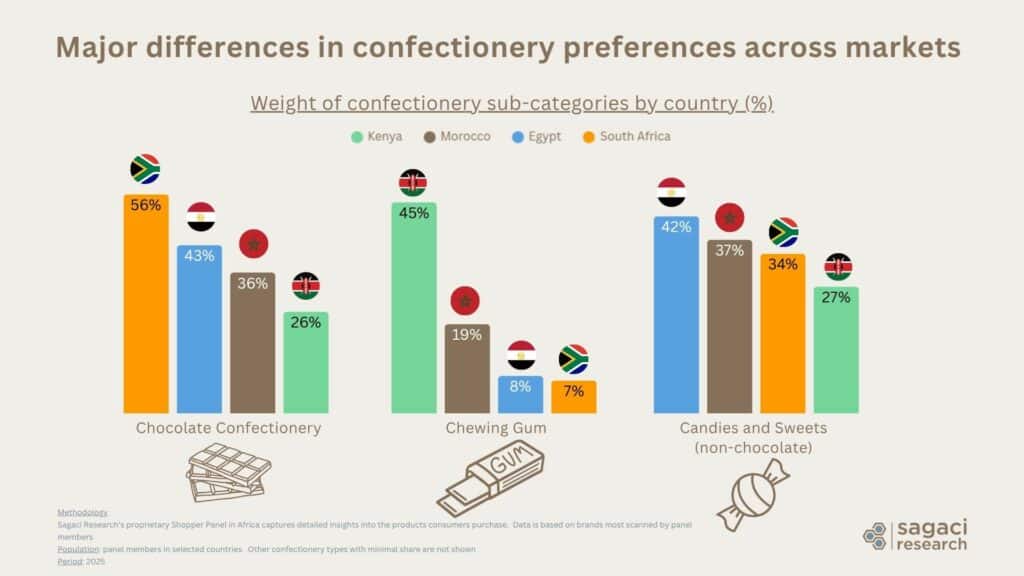

Chocolate leads in South Africa (56%) and Egypt (43%), while Kenya heavily skews to chewing gum (45%). Non-chocolate candies are strongest in Egypt (42%) and Morocco (37%) (vs. South Africa 34% and Kenya 27%), with gum relatively small in South Africa (7%).

These skews underline the need to localize product mix, pricing, and retail execution by market.

This kind of market-specific insight is essential for confectionery brands to align their product mix, marketing, and retail strategy with local consumer preferences across Africa.

What are the top confectionery brands in African markets?

Looking at the most scanned confectionery brands across Egypt, Kenya, South Africa, and Morocco, a few patterns emerge.

Cadbury, owned by Mondelēz International, dominates in Egypt, Kenya, and South Africa, demonstrating strong regional penetration across chocolate segments.

In Egypt, it’s flanked by local favorite El Bawadi (from Harvest Foods) and Galaxy, a chocolate brand from Mars Inc..

In Kenya, local brand Mr. Berry’s takes the lead, reflecting strong domestic preference, followed by Cadbury and gum brand Fresh (by Kenafric). South African consumers show a more balanced confectionery profile, with Beacon (by Tiger Brands) and Maynards (also part of Beacon’s portfolio) ranking in the top 3.

Meanwhile in Morocco, the gum category stands out with Clorets (owned by Perfetti Van Melle) leading the chart, alongside Flash (by Maghreb Industries) and Milka, another Mondelēz brand.

This diversity highlights not only the cross-border strength of international giants but also the resilience and popularity of local and regional players in specific markets.

Key demographics of Cadbury consumers in South Africa

Zooming in on the confectionery market in South Africa, Cadbury emerges as the leading brand. Its buyers stand out from the broader category, with some differences in age, gender, and socioeconomic profile.

In South Africa, Cadbury appeals most strongly to women and younger consumers. Shoppers aged 18–25 are more represented among Cadbury buyers (25%) than among other chocolate brand consumers (21%). Women also make up a slightly larger share of Cadbury’s audience (72% vs. 70%). However, while SEC A represents the largest socioeconomic group among confectionery consumers overall, it is slightly under-represented among Cadbury buyers in South Africa.

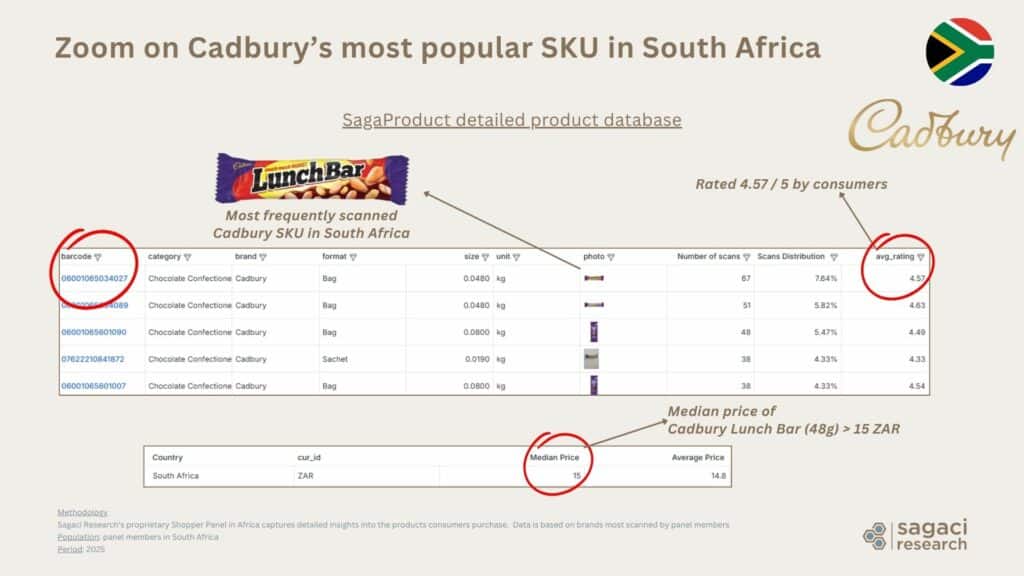

Most popular Cadbury product in South Africa: Lunch Bar takes the lead

Among all Cadbury’s SKUs captured in South Africa, the Lunch Bar (48g) stands out as the most scanned product by panelists. With a consumer rating of 4.57 out of 5 and a median price of over 15 ZAR, it represents a strong performer in terms of both popularity and perceived value. This granular product-level insight is critical for pricing strategy and retail execution.

Want more insights on the confectionery market in Africa?

With SagaProduct, brands can access real shopper behaviour data in Africa across all trade channels. From brand penetration to SKU-level analysis and market trends tracking, SagaProduct helps marketers stay on top of evolving consumer preferences and competitive dynamics in the African confectionery market.

For more insights on the confectionery sector in Africa or to explore how SagaProduct can support your strategy, get in touch at contact@sagaciresearch.com.

Methodology

SagaProduct, Sagaci Research‘s proprietary Shopper Panel in Africa, captures detailed insights into the products consumers purchase. Data is based on brands most scanned by panel members.

Population: panel members in 54 African countries

Period: 2025