- 03/11/2025

- Posted by: Janick Pettit

- Categories: Articles, Consumer Goods / FMCG, e-commerce, Online Panels

As the Black Friday phenomenon spreads across Africa, new data from Sagaci Research reveals how consumers perceive and engage with this fast-growing retail event originally from the United States. From awareness to purchase intent and product choices, the results show both the reach and the limits of Black Friday in African markets.

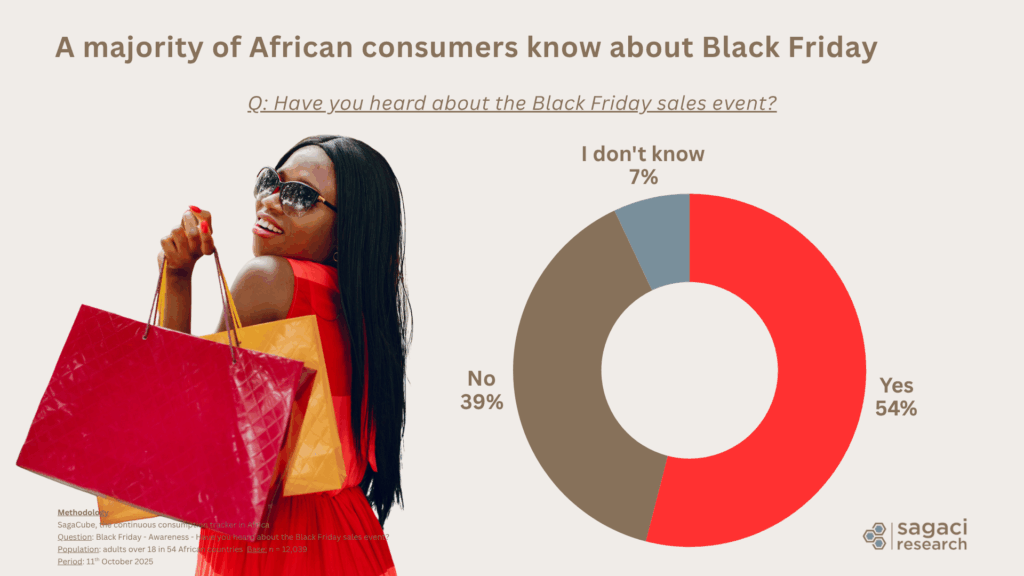

How well do African consumers know Black Friday?

More than half of African respondents (54%) say they have heard of Black Friday, while 39% are not yet familiar with it.

This strong awareness reflects the growing presence of modern retail chains, e-commerce platforms, and digital campaigns promoting the event across African markets. Major players such as Jumia, Kilimall, Takealot, Amazon, or Massmart stores in South Africa (Game, Makro, Builders) have helped build anticipation around end-of-year deals.

African shoppers are drawn by discounts, but some stay cautious

Among those aware of Black Friday, more than half (53%) say they love discounts and sales and see the event as a good opportunity to save. However, a significant one-third (34%) remain indifferent or unsure, often saying they “don’t buy much anyway.” Another 12% reject the concept altogether, viewing it as overly commercial.

This split suggests that while the appetite for deals is high, engagement still depends on consumers’ purchasing power, shopping frequency, and perceptions of authenticity behind advertised discounts.

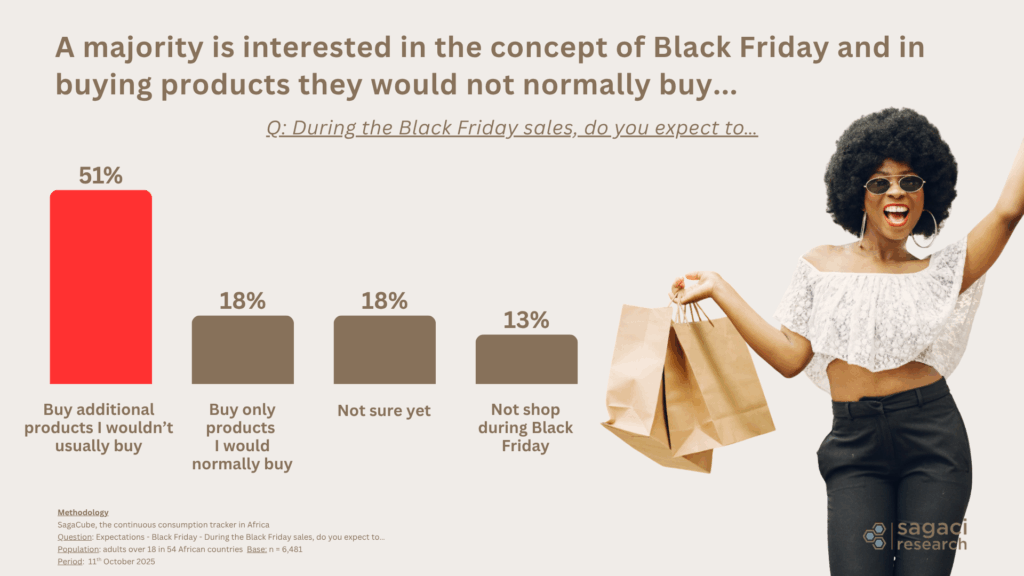

Black Friday in Africa: discounts unlock new spending

Among those aware of the event, half are planning to shop during Black Friday (51%), saying they expect to buy products they wouldn’t normally purchase. It shows that even amid tighter budgets, the promise of discounts can unlock new spending.

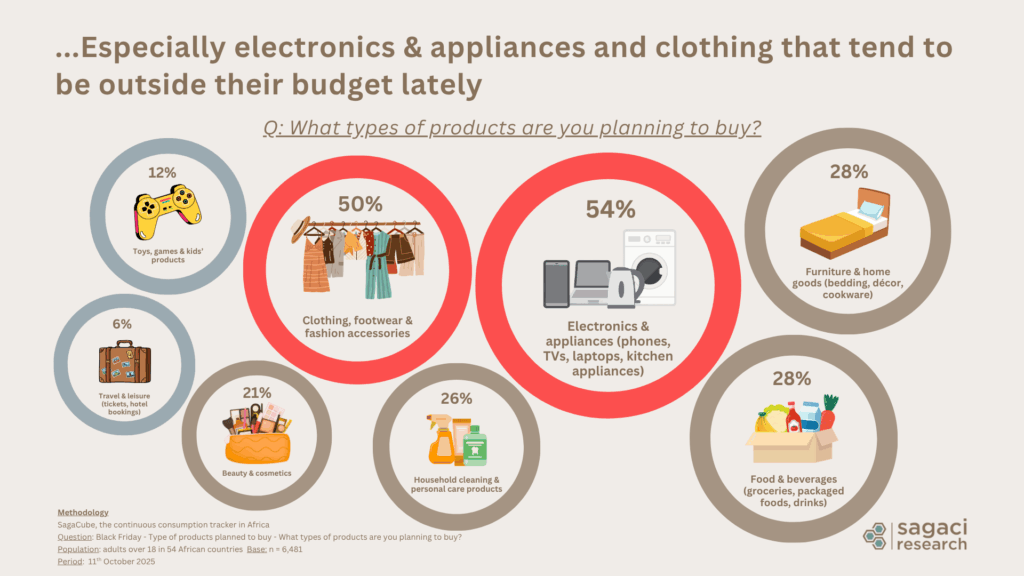

What African shoppers plan to buy on Black Friday

Whereas historically Black Friday was about big screen TVs, in Africa it remains anchored in electronics, with electronics and appliances the most planned buys at 54 percent, ahead of clothing, footwear, and fashion accessories at 50 percent. Yet many shoppers also target essentials, including food and beverages, and homeware, given current budget pressures.

Here is the list of the top Black Friday categories in Africa:

- Electronics & appliances (phone, TVs, laptops, kitchen appliances) – 54%

- Clothing, footwear & fashion accessories – 50%

- Furniture & home goods (bedding, décor, cookware) – 28%

- Food & Beverages (groceries, packaged foods, drinks) – 28%

- Household cleaning & personal care products – 26%

- Beauty & Cosmetics – 21%

- Toys, games & kids’ products – 12%

- Travel & leisure (tickets, hotel bookings) – 6%

This aligns with findings from our recent article on Africa’s middle class being under pressure, where we observed that households have been cutting expenses in items such as clothing and electronics, precisely the two categories topping this year’s Black Friday shopping lists.

For many middle-class families, Black Friday becomes a rare opportunity to afford items they’ve postponed for months, especially big-ticket or non-essential purchases.

Where African consumers shop for Black Friday deals

Shopping for Black Friday in Africa is omnichannel. Consumers expect a smooth handoff between online and stores, and retailers that combine click and collect, mobile apps, and in-store pickup gain an edge. As mobile money usage becomes increasingly widespread across Africa, with 30% of users using it to pay in stores, online marketplaces naturally lead Black Friday shopping choices.

Where African consumers plan to shop for Black Friday deals:

- 32% of respondents plan to buy through online marketplaces

- 22% at shopping malls or brand stores

- 22% in supermarkets or hypermarkets

Smaller shares expect to buy from discounters (9%), open markets (8%), or social media sellers (6%). This points to growing trust in formal retail and e-commerce platforms, where deals feel more transparent and secure, especially for higher-value items.

Key takeaways: Black Friday in Africa is growing

Black Friday is no longer a purely imported concept. African consumers are making it their own, using it strategically to stretch household budgets and access products that are otherwise out of reach. Awareness is high, interest is solid, and participation continues to grow, particularly among urban middle-class households balancing affordability and aspiration.

For brands and retailers, the event offers a critical opportunity to reconnect with shoppers under financial pressure, reward loyalty, and build long-term value through clear pricing and trustworthy promotions.

Consumer research into African shopper behaviour with Sagaci Research

Our online panel in Africa provides real-time access to shopper opinions and purchase intent across 54 markets. You can go beyond awareness data to quantify category trends, purchase frequency, and consumer motivations before and after major retail events like Black Friday.

Contact our team at contact@sagaciresearch.com or click below to explore how African shoppers make decisions, and how your brand can capture their attention during peak shopping moments.

Methodology

Survey conducted via our Online Panel in Africa covering 54 countries leveraging SagaPoll panel

Questions:

- Have you heard about the Black Friday sales event?

- Black Friday is a sales event initiated in the US where companies offer deep discounts mostly on non-food items (appliances, clothing,…). Is this something you could benefit from?

- During the Black Friday sales, do you expect to… Not sure yet / Buy additional products I wouldn’t usually buy (because of the discounts) / Buy only products I would normally buy / Not shop during Black Friday

- What types of products are you planning to buy?

Population: Adults over 18 in 54 African countries

Base: n = 12,039

Images: Feature image designed by Freepik