- 12/01/2026

- Posted by: Janick Pettit

- Categories: Articles, Qualitative Research

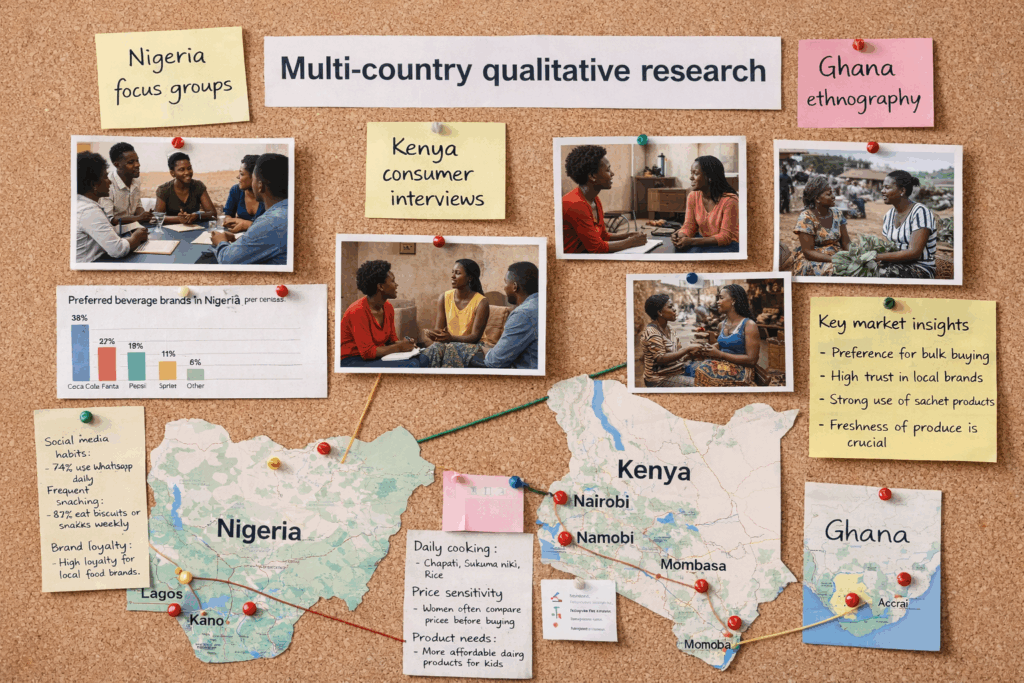

Running multi-country qualitative research in Africa can be is complex. Differences in culture, language, and consumption habits mean that qualitative research across multiple markets in Africa requires a structured yet locally grounded approach.

At Sagaci Research, we design and manage qualitative research using a structured, multi-country approach that allows decision makers to compare markets with confidence while preserving local nuance. This approach builds on our broader expertise in qualitative research solutions in Africa, supporting regional strategy, innovation, and brand decisions across the continent.

Designing multi country qualitative research in Africa for comparability

Multi country qualitative research only creates value when insights can be compared meaningfully. Our projects are built around a single methodological framework applied consistently across all markets, from study design to analysis.

In practice, this means aligning core elements from the start:

- discussion guides structured around the same research questions while being carefully adapted to local language, culture, and context

- recruitment criteria harmonized across countries

- analysis frameworks designed to generate comparable African consumer insights

This ensures that insights collected in different markets speak the same analytical language, even when consumer realities differ.

Conducting fieldwork concurrently across African markets

Wherever possible, qualitative research on the continent is conducted concurrently across countries. Running studies in parallel reduces overall timelines and ensures insights are captured within the same economic and competitive context.

Clients benefit from a centralized coordination model that includes:

- one single point of contact managing all markets

- aligned fieldwork calendars

- centralized quality control for regional and Pan-African consumer research projects

Combining regional oversight with strong local execution

High quality qualitative research depends on strong local execution. Our model combines in-house senior qualitative experts with experienced local moderators and recruiters in each market.

This structure allows us to balance:

- detailed country level reports with local insights

- a consolidated cross country report highlighting similarities, differences, and strategic business implications

Recruitment quality is a critical success factor in qualitative research in Africa. Our approach follows the best practices described in how to manage successful recruitment in qualitative research in Africa, ensuring the right respondents and reliable insights across markets.

Focus groups and in depth interviews in African markets

We deploy a range of qualitative methodologies depending on the research objective, including focus groups, in depth interviews, ethnographic approaches, and hybrid designs.

When well designed and carefully moderated, focus groups in Africa remain a powerful tool to explore shared perceptions, test concepts, and understand social dynamics. Our experience in running focus groups across Africa is built on robust recruitment, local moderation, and consistent analytical frameworks.

Clear outputs for regional and local FMCG teams

Each qualitative project delivers structured outputs designed to support decision making at different levels.

Typically, this includes:

- detailed country level reports with local insights

- a consolidated cross country report highlighting similarities, differences, and strategic business implications

This structure allows local teams to act quickly while enabling regional teams to compare markets and prioritize actions with clarity.

Typical FMCG use cases across Africa

Qualitative research in Africa is frequently used by FMCG brands to support:

- consumer needs and usage exploration across markets

- brand positioning and communication testing before regional rollouts

- product, packaging, or innovation concept development

- shopper behaviour and path to purchase analysis

These studies often inform high impact regional decisions where Pan-African consumer research alignment is critical.

Building confident regional decisions through qualitative research

Qualitative research in Africa delivers its full value when it combines local depth with regional consistency. A structured multi-country qualitative research approach, strong local execution, and centralized oversight allow FMCG brands to move beyond fragmented insights and build strategies that work across markets.

If you are planning a qualitative project in Africa and want to ensure consistency, speed, and high quality insights across markets, book a call with our qualitative team to discuss your needs. We will explore together how we can support your African consumer insights and research objectives.

Frequently Asked Questions

Qualitative research in Africa explores the “why” behind consumer behaviours, attitudes, and perceptions through methods such as interviews and focus groups. Quantitative research measures how widespread those behaviours are using structured surveys and larger samples. Research often combine both approaches to inform FMCG decisions.

How many African countries can be covered in one qualitative study?

A single qualitative study can cover anywhere from one to dozens African countries, depending on objectives, timelines, and budget. With a structured multi-country approach, we can run studies concurrently while maintaining consistency and comparability across markets.

Are focus groups effective across different African cultures?

A single qualitative study can cover anywhere from one to dozens African countries, depending on objectives, timelines, and budget. With a structured multi-country approach, we can run studies concurrently while maintaining consistency and comparability across markets.

How long does a multi-country qualitative research project in Africa usually take?

Multi-country qualitative research projects in Africa take typically four to eight weeks from design to final reporting but this can vary based on the number of countries, recruitment complexity, and whether fieldwork is conducted concurrently.

When should FMCG brands use qualitative research in Africa?

FMCG brands typically use qualitative research in Africa ahead of regional launches, brand repositioning, communication testing, or innovation development, especially when understanding local context and cross country differences is critical.