- 02/12/2025

- Posted by: Janick Pettit

- Categories: Articles, Consumer Goods / FMCG, SagaProduct, Zimbabwe

Understanding which consumer goods truly dominate everyday consumption in Zimbabwe is not always easy. Often, traditional data often leaves significant blind spots since many household purchases happen across informal outlets, small groceries and markets with limited reporting.

To address this, using thousands of product scans collected by our Shopper panel in Zimbabwe, this ranking reveals which brands make it most often into Zimbabwean baskets across categories and price points.

Our panel captures brand, item and pack details directly from real shoppers, including barcodes, prices, pack sizes and consumer ratings (on a scale from 1 to 5). This is a clear view of actual behaviour, not stated intention. With this in mind, read on to discover the list of the most popular consumer goods in Zimbabwe over the last 12 months (Nov 2024 to Nov 2025).

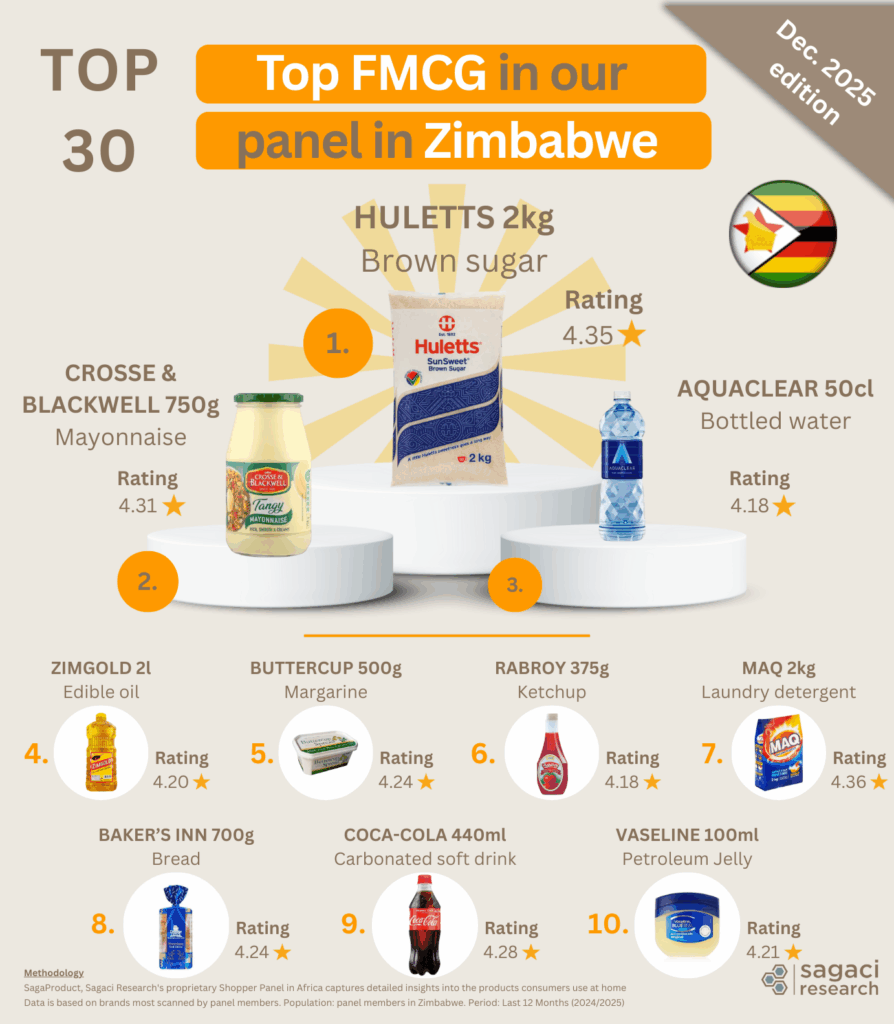

Top 30 consumer goods in Zimbabwe: full ranking

Here are the top 30 consumer goods most frequently scanned by households in Zimbabwe.

1. Huletts, sugar and sweeteners, 2kg plastic wrap (by Tongaat Hulett)

2. Crosse and Blackwell, mayonnaise, 750g glass bottle (by Tiger Brands)

3. Aquaclear, bottled water, 0.5l plastic bottle (by PepsiCo)

4. Zimgold, edible oil, 2l plastic bottle (by Zimgold)

5. Buttercup, margarine, 500g (by Olivine)

6. Rabroy, ketchup, 375ml plastic bottle (by Dairibord Holdings)

7. Maq, laundry detergents, 2kg bag (by Bliss Brands)

8. Baker’s Inn, bread, 700g (by Innscor)

9. Coca-Cola, carbonated soft drink, 440ml plastic bottle (by Delta Corporation)

10. Vaseline, petroleum jelly, 100ml (by Unilever)

11. Red Seal, salt, 1kg bag (by Innscor)

12. Vaseline, petroleum jelly, 250ml cup or pot (by Unilever)

13. Pure Drop, edible oil, 2l plastic bottle (by Surface Wilmar)

14. Proton, bread, 18 slices (by Proton Bakers)

15. Sun, jam, 0.5 kg plastic bottle (by Cairns Food Ltd)

16. Pepsi, carbonated soft drinks, 50cl plastic bottle (by Varun Beverages)

17. Mazoe, juice, 2l plastic bottle (by Schweppes Zimbabwe)

18. Gloria, flour, 2kg bag (by National Foods Holding Ltd)

19. Quick Brew, tea, 125g paper box (by Dairibord Holdings)

20. Lion, matches, 40 units (by The Lion Match Company)

21. Kiwi, shoe polish, 50ml (by SC Johnson)

22. Coca-Cola, carbonated soft drinks, 2l plastic bottle (by Delta Corporation)

23. Dairibord, sour milk, 50cl plastic bottle (by Dairibord Holdings)

24. Cheeky Chilli, ketchup, 200ml plastic bottle (by Cheeky Chilli)

25. Lobel’s Bread, bread, 700g (by Lobel’s Bread)

26. Aromat (Knorr), herbs and spices, 75g can (by Unilever)

27. Colgate, toothpaste, 100ml (by Colgate Palmolive)

28. Nescafé Ricoffy, coffee, 100g can (by Nestlé)

29. Ellis Brown, powder milk, 375g sachet (by AVI Limited)

30. Olivine, edible oil, 2l bottle (by Olivine)

Household staples shape everyday consumer behaviour in Zimbabwe

The ranking of top consumer goods in Zimbabwe shows that household staples remain central to daily shopping habits. In particular, categories such as sugar, flour, edible oils, bread, margarine, salt, tea, and bottled water appear consistently in shopper baskets across both modern trade and traditional trade in Zimbabwe.

Some key insights:

- Zimbabwean households continue to prioritise basic food and beverage categories

- The impact of inflation on consumer spending drives careful product selection

- Strong performance relies on SKU optimisation, pricing discipline and wide availability

As a result, for manufacturers, pricing architecture and pack strategy matter more than emotional positioning. A competitive price point and steady distribution remain essential to defend share in staple categories.

Local manufacturers drive key food and beverage categories

A large share of the top grocery products in Zimbabwe comes from local and regional players. For example, brands from Innscor, Olivine, National Foods Zimbabwe, Zimgold, Surface Wilmar, Cairns Foods, and Dairibord dominate core categories like bread, oils, spreads, flour, juices and dairy. Their advantage is rooted in local production, reliable sourcing and strong penetration in retail channels in Zimbabwe.

Why local suppliers perform well:

- Strong presence in both formal and informal retail

- Competitive pricing and affordable household essentials

- High familiarity and trust among shoppers

Meanwhile, global companies still lead where formulation and product quality matter most. This is visible in categories like petroleum jelly, toothpaste, coffee and seasonings through Vaseline, Knorr, Nescafé, and Colgate. Ultimately, the implication for marketers is clear. In Zimbabwe, execution in route to market matters as much as brand equity.

Value-driven pack sizes dominate FMCG choices in Zimbabwe

Across the dataset, mid-sized formats dominate the top consumer goods in Zimbabwe. These value-driven packs suit both weekly and monthly shopping missions, making them especially attractive in an inflationary environment.

Most common winning sizes:

- Two kilogram bags for sugar, flour, and laundry detergent brands

- Two litre PET bottles for cooking oil brands in Zimbabwe and juices

- 40 to 50cl bottles for soft drinks from Coca-Cola (Delta Corporation) and Pepsi (Varun Beverages)

- Compact 100 to 250ml packs for personal care

Overall, these formats balance affordability and quantity, which aligns with real household behaviour. They sit at the heart of consumer goods consumption in Zimbabwe and should be protected as priority SKUs within any FMCG portfolio.

Explore the full picture behind Zimbabwe’s consumer goods market

This ranking provides only a snapshot of what sits in Zimbabwean homes. However, with SagaProduct, you can go deeper and analyse performance at the SKU level across regions, formats, price tiers and retail channels. Our online panel captures barcode, pack size, packaging type and ratings, giving you a complete picture of category dynamics in your market(s).

So if your team needs detailed insights on a specific category or wants to explore shopper behaviour in more depth, contact us for a tailored FMCG report.

Methodology

SagaProduct, Sagaci Research’s proprietary Shopper Panel in Africa captures detailed insights into the products consumers use at home.

Data from SagaProduct, based on brands most scanned by members of our online panel in Zimbabwe.

Population: panel members in Zimbabwe

Period: Year to date / last 12 Months as of November 2025