Market research in Mauritania

As Mauritania recovers from the shock imposed by the Covid-19 pandemic, it should continue on the path it set before it. With improvement in a number of living standard metrics, and changing lifestyles, Mauritania’s consumer base is becoming more affluent. The economy is diversifying, and sectors such as Tourism, Energy, and telecommunications are growing. Investments in infrastructure are coming to fruition, with improved roads and buildings.

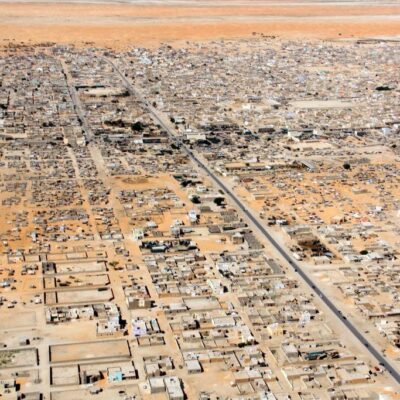

About Mauritania

Mauritania, located in Western Africa, is mainly a Saharan country, made up of 75% by desert. The southern part of the country, along the Senegal River and borders Mali, is semi-arid and is part of the Sahel Region. This geographic demarcation marks the border between two distinct regions, the Sahel and Maghreb countries to the north.

As a result, the country has historically been at the center of trade between the two regions, with the country being associated with a tradition favorable to free markets, personal mobility, and entrepreneurship.

Why conduct market research

Mauritania was poised for very strong growth estimated at 5.7% before the Covid-19 pandemic, highlighting a successful restructuring of the economy, the successful implementation of more liberal policies, and increased foreign investment. A strong history of nomadic poverty weighs on the country, but recent efforts have improved living standards. The country is also witnessing a boom in a new hydrocarbon sector, thanks to the recent discovery of large deposits off the coast of Mauritania and Senegal. The discovery and its subsequent exploitation, is set to allow the government to double its revenue when it begins production in 2022. Additionally, since 2017, the number of annual visitors has increased by 166%, allowing for further diversification of the economy.

However, there remains some challenges in the country, high levels of poverty, inequality, malnutrition, and illiteracy are prevalent. For now, the economy is heavily dependent on its mineral, with iron ore accounting for 46% of its total exports.

Representative market data

Despite improvements, a large part of the country is illiterate. Coupled with improving but as of now limited infrastructure, conducting market research can be difficult and costly. Here at Sagaci Research, we are able to provide you unparalleled access to insights about Mauritania’s consumer base.

Here are some of the ways we can help you:

Market research methods in Mauritania

Online Panel

An online panel across Mauritania available for your needs. Receive access to our online panel and get answers to your questions from your target demographic in an incredible turnaround time. Click here for more information.

SagaBrand

Track your brand’s performance and turn valuable insights into results. We provide reports on a monthly, quarterly, or bi-annual basis; choose the best option for your business and start to monitor your brand health. Find out about your options here.

SagaCube

Gain access to a unique in depth report about the consumption habits of your target consumers. Choose from a list of over 140 items within your country of interest and download your report today! Gain access here.

SagaTracker

Get key information about which retail channels are most effective for your products. Get access to direct measurements in a tailor-made fashion for your needs. Contact us here.

More about syndicated research in Mauritania

-

Lip Products market in Angola

Detailed insights on the lip products market in Angola Explore in-depth insights into the lip products market in Angola, drawn from real consumer data. This market report analyzes key consumption trends, top lip products brands, packaging preferences, and shopper behaviour within the lip products category. Built from our proprietary data tools, it provides a detailed

04/07/2025 -

Liquid Soap market in Angola

Detailed insights on the liquid soap market in Angola Explore in-depth insights into the liquid soap market in Angola, drawn from real consumer data. This market report analyzes key consumption trends, top liquid soap brands, packaging preferences, and shopper behaviour within the liquid soap category. Built from our proprietary data tools, it provides a detailed

04/07/2025 -

Vodka market in Angola

Detailed insights on the vodka market in Angola Explore in-depth insights into the vodka market in Angola, drawn from real consumer data. This market report analyzes key consumption trends, top vodka brands, packaging preferences, and shopper behaviour within the vodka category. Built from our proprietary data tools, it provides a detailed look at market dynamics,

04/07/2025 -

Preserved Meats market in Angola

Detailed insights on the preserved meats market in Angola Explore in-depth insights into the preserved meats market in Angola, drawn from real consumer data. This market report analyzes key consumption trends, top preserved meats brands, packaging preferences, and shopper behaviour within the preserved meats category. Built from our proprietary data tools, it provides a detailed

04/07/2025